Debt consolidation mortgages offer a strategic way to manage multiple high-interest credit card debts by combining them into one new loan with potentially lower rates and more manageable terms. This simplifies repayment, saves on fees, and reduces the overall cost of debt over time, similar to consolidating multiple home loans. To secure one, evaluate financial health and credit score, research lenders comparing interest rates and fees, prepare necessary documents, be transparent about financial history, and review loan terms with a structured repayment plan for effective management.

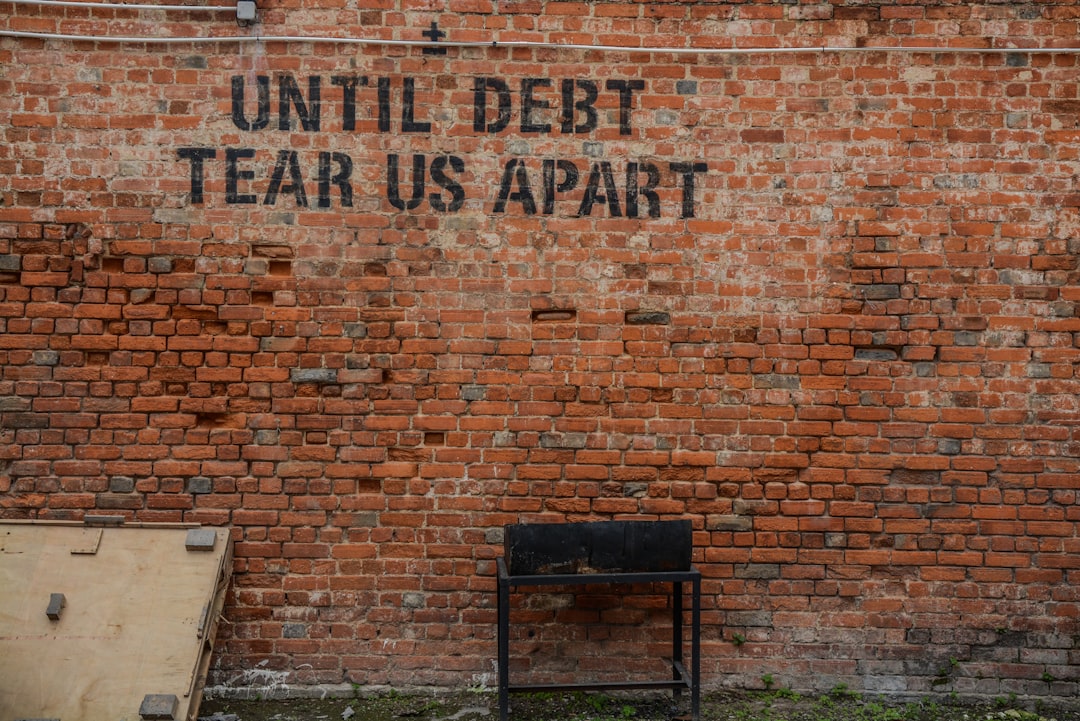

Looking to escape the cycle of high credit card interest rates? Debt consolidation loans could be your path to financial freedom. This article explores how debt consolidation mortgages offer a strategic approach to paying off credit card balances, providing a unified repayment plan with potentially lower interest rates. We’ll delve into the benefits, from improved cash flow to long-term savings, and guide you through the steps to secure and manage this effective debt relief solution.

- Understanding Debt Consolidation Loans

- Benefits of Using Debt Consolidation for Credit Card Balances

- Steps to Secure and Manage a Debt Consolidation Mortgage

Understanding Debt Consolidation Loans

Debt consolidation loans offer a strategic approach to managing multiple debts, especially high-interest credit card balances. This type of loan allows borrowers to combine several outstanding debts into one new loan with potentially lower interest rates and more manageable terms. The primary goal is to simplify repayment by reducing the number of payments needed each month, which can help save on fees and reduce the overall cost of debt over time.

Unlike credit cards, which often come with variable interest rates, debt consolidation loans typically offer a fixed rate, providing borrowers with budget predictability. This process involves taking out a new loan to pay off existing debts, effectively consolidating them into one. It’s similar to how a mortgage consolidates multiple home loans into one, making repayment more straightforward. Effective use of debt consolidation mortgages can lead to financial relief and faster debt elimination for those burdened by credit card debt.

Benefits of Using Debt Consolidation for Credit Card Balances

Debt consolidation is a powerful tool for individuals burdened by multiple credit card balances. By taking out a debt consolidation mortgage, borrowers can combine several high-interest credit card debts into one single loan with a lower interest rate. This simplifies repayment by reducing the number of payments needed each month, making it easier to stay on top of repayments and avoid missing payments due to the sheer number of bills.

Additionally, debt consolidation offers the advantage of potentially saving money on interest charges over time. With a lower overall interest rate, borrowers can reduce the total amount they pay in interest throughout the life of their debt. This can free up financial resources that were previously spent on credit card interests, allowing individuals to allocate those funds towards other priorities or savings goals.

Steps to Secure and Manage a Debt Consolidation Mortgage

To secure a debt consolidation mortgage, begin by assessing your financial situation and credit score. This step is crucial as it determines your eligibility for various loan options and interest rates. You can improve your chances by ensuring timely bill payments and reducing outstanding debts. Next, research different lenders and compare their terms, including interest rates, repayment periods, and any associated fees. It’s beneficial to consider both traditional banks and online lenders, as the latter often offer more flexible options.

Once you’ve identified a suitable lender, gather necessary documents, such as proof of income, employment details, and identification. Prepare these in advance to streamline the application process. During the application, be transparent about your financial history, including any previous debt consolidation attempts. The lender will assess your ability to repay based on your income-to-debt ratio and overall creditworthiness. After approval, carefully review the loan terms and create a structured repayment plan to manage your debt consolidation mortgage effectively.

Debt consolidation mortgages can be a strategic tool to manage credit card balances effectively. By understanding the process, leveraging its benefits, and following secure management steps, individuals can achieve financial freedom and avoid the pitfalls of high-interest credit card debt. This approach simplifies payments, reduces stress, and empowers folks to focus on building a healthier financial future.